Grab your replays and workbook –> HERE

It’s not too late to share with your friends. Send them your personalized link or have them join atbit.ly/2024slaywithstocks

If you missed some of the challenge and would like to review previous days, you can view the previous days –-> here.

This training/challenge is for educational and informational purposes only. These materials do not constitute a recommendation to engage in any particular securities transactions.

Investment products are: Not FDIC Insured | Not Guaranteed by the bank | May lose value

Week 2: Make it Slay – Stock Trading

This week it’s time for some action as a new investor. You’ll learn by doing when it comes to purchasing stocks and navigating the stock market to help you build a foundation for investing for years to come. No need to fear – We got you!

Brokerage Account

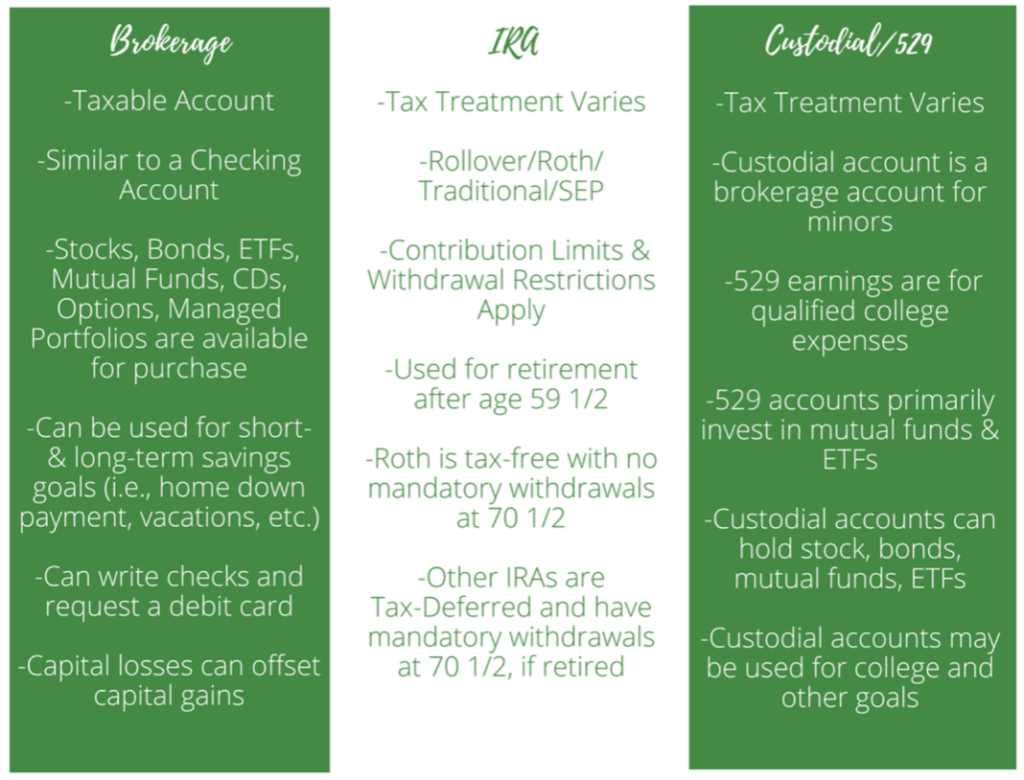

An account with a firm that allows you to deposit funds and place investment orders. Think of a brokerage account as an upscale checking account that allows you to hold funds, write checks, and purchase investment products such as stocks, bonds, mutual funds and so much more. Brokerage accounts are covered under SIPC (Securities Investors Protection Corporation) with higher coverage amounts on cash and investments, if a brokerage firm doesn’t do right by you..

There are several types of brokerage accounts. These accounts can range from Full Service (done-for-you), that provide extensive investment advice and charge high service fees or Discount Service (do-it-yourself), that are available to you online and charge low fees. For the purposes of this challenge, we will discuss Discount Brokerage Firms. With a discount brokerage firm, you want a secure platform that allows you to submit investment orders. In addition, you want to consider the speed in which your orders are placed, the research tools available to you, and the variety of investment products you can choose from.

Day 8 – Accounts: Standing On Business

Today, there are several types of accounts you can open at a discount brokerage firm. What type of account(s) should you open? It all depends on your goal(s). You can open one or more accounts at a brokerage firm that can help you meet your financial goals. Which will you open? Let’s take a look at each account, briefly.

Getting Started

Micro-Investing Apps: If you are starting with little to no money (less than $50), then you can start with a “Micro-Investing” App. These apps allow you to link your checking account to their service. As you make daily purchases, then the service will round up your purchase amount to the nearest dollar and invest the change in mutual funds or ETFs (exchange-traded funds) on your behalf. However, once you reach a higher account balance, then you may want to transfer your funds to another option. Here’s a brief look at the most popular “Micro-Investing” apps.

Fractional Shares: So you have your heart set on owning a particular company, such as Disney, Tesla or Amazon. However, the stock price is more than what you can afford at the moment. There are some brokerage firms that will allow you to purchase fractional shares – a small portion of a whole share – where you can put as little as $20 towards owning a piece of your favorite companies. There is a commission charge involved and if the company issues dividends, then you are entitled to receive a fractional share of the dividend payment amount. Currently, Stockpile is a brokerage firm that allows you to allows you to purchase fractional shares of a company, especially for those companies with expensive share prices, such as Amazon.

Online Discount Brokers: This category of brokerage firms continue to have new players emerge on the scene. Some firms will provide offers of no-commission trades or reduced commissions for a limited time to get you to open an account. Be sure to understand any restrictions with the offer and what you will pay per trade once the offer expires. At most brokerage firms, you should be able to buy whatever stocks you like. Here’s a brief look at the most popular online, discount brokerage firms for your review.

Today’s Investing Activity: Today’s activity focuses on taking action. In order to meet your goals you outlined on Day 1, you must have an account to assist you in meeting those goals.

Determine which brokerage account(s) will help you meet your financial goals. Select a brokerage firm and visit their website. Open an account. (Please note: I am unable to recommend any particular firm, at this time.)

You can use my “Brokerage Account Checklist“ to help you with today’s activity. Feel free to take a screen shot of your worksheet and share with the group or leave a comment with where you opened your account and what type of account (i.e., I opened a Roth IRA account at Robinhood).

If you already have a(n) account(s) with a firm, then complete the worksheet to determine if the firm continues to meet your needs.

STEP ONE:

Select the account that fits your needs

Use the worksheet to help you identify the account details

STEP TWO:

Open an account

STEP THREE:

Share a screenshot of your worksheet or let us know where you opened (or have opened) your account(s) and what type of account(s). You can let us know in The Stocks & Stilettos Society or in the comments belowToday’s activity focuses on taking action. In order to meet your goals you outlined on Day 1, you must have an account to assist you in meeting those goals.

Tomorrow: Day 9 – Stock Research

Follow me here: Instagram: @StocksandStilettos | Facebook: @StocksandStilettos | X: @StocknStiletto

Group: bit.ly/stocksandstilettos

Happy Investing!

Cassandra

After researching and using the checklist, I will open a brokerage account tomorrow with Fidelity. I chose Fidelity because it offers fractional shares.

I had opened a Robinhood account in 2022. I was given $5.00 to open the account. I picked SIRI for my stock and never looked at it again. I went in there today and I have $10.00 Woot woot. The plan here is to get my niece’s and my grandaughter’s engaged in this education and process. I will ask them to open a RobinHood account so we can all use this platform to educate ourselves.

I also have an E-Trade account where I will use this platform to plan for my individual goals.

we will start small while we learn and grow as we go.