It’s not too late to share with your friends. Send them your personalized link or have them join at bit.ly/2024slaywithstocks

If you missed some of the challenge and would like to review previous days, you can view the previous days –> here.

This training/challenge is for educational and informational purposes only. These materials do not constitute a recommendation to engage in any particular securities transactions.

Investment products are: Not FDIC Insured | Not Guaranteed by the bank | May lose value

Week 1: Let it Slay – Stock Basics

This week is all about setting the stage to be successful as a new investor. You’ll get an introduction to stocks and the stock market to help you build a foundation for investing for years to come. No need to fear – We’re starting at the bottom and will work our way to the top. This is a great place to start on your investing journey.

Dividends

Dividends are a portion of a company’s earnings paid out to the shareholders. If you own stock in a company that pays dividends, then you can receive those dividends as cash, stock, or some other form of property. Dividends are decided by the board of directors for a company and the amount can change. A company may provide shareholders with dividends monthly, quarterly, or annually. Not all companies provide dividends and there are some companies that may issue dividends on an infrequent basis. For the purposes of this challenge, we will focus on cash dividends.

Day 5 – Account Elevation: Dividends

The Dividend Rate tells you how much you will receive in terms of dollar per share. The Dividend Yieldtells you the return on your investment in terms of a percent. To an investor, understanding the dividend yield is more important than the rate because it really tells you how much “bang for your buck” you are getting. The higher the dividend, the better the bang and obviously, more bucks. Although a company’s stock price may not move very much in either direction, you can still make money if the company issues dividends. Ultimately, you want a company to provide both: an increasing stock price and a consistent dividend. It’s truly a win-win and will put your investment account on steroids.

With receiving dividends to reinvest, compounding interest to grow your account and you consistently buying shares, it’s a formula for reaching your financial goals that give you peace of mind. You can stack your money by indicating that you want to reinvest the dividends. This will trigger the brokerage firm to simply buy more shares for you, which helps to increase your dividend payout the next time the company issues them. If you are looking to receive a check, you can also have your dividends paid out to you. Investors looking for dividend income need to look for companies that have a high and very stable dividend yield for cash flow purposes. If you decide to cash out, then the dividend income will be added to your income for tax purposes.

Getting Paid

In order to receive a dividend, you must own the stock by a certain date. This date is called the “Ex-Dividend” date. All shareholders are eligible to get paid a dividend if they own the stock on this date. Once the board of directors declares a dividend, they will let the public know (which includes you, too), the very critical “Ex-dividend” date. They will also announce the amount of the dividend and the date you can expect to receive your payment or have the funds reinvested into your account. If you have been watching a stock and want to buy, then you must buy the stock at least 3 business days prior to the “Ex-Dividend” date to be sure you can get your money. Lastly, if you decide to sell your stock after the “Ex-Dividend” date, the company will still cash you out and you will receive a dividend payment. Pretty cool, right?

Today’s Investing Activity: Use the stocks from your watch list to locate the dividend information for each stock. Calculate what the dividend payment will be (or would have been) on 1,000 shares.

You can use my “Dividend Worksheet“ to help you with today’s activity. Feel free to take a screen shot of your worksheet and share with the group or leave a comment with your results.

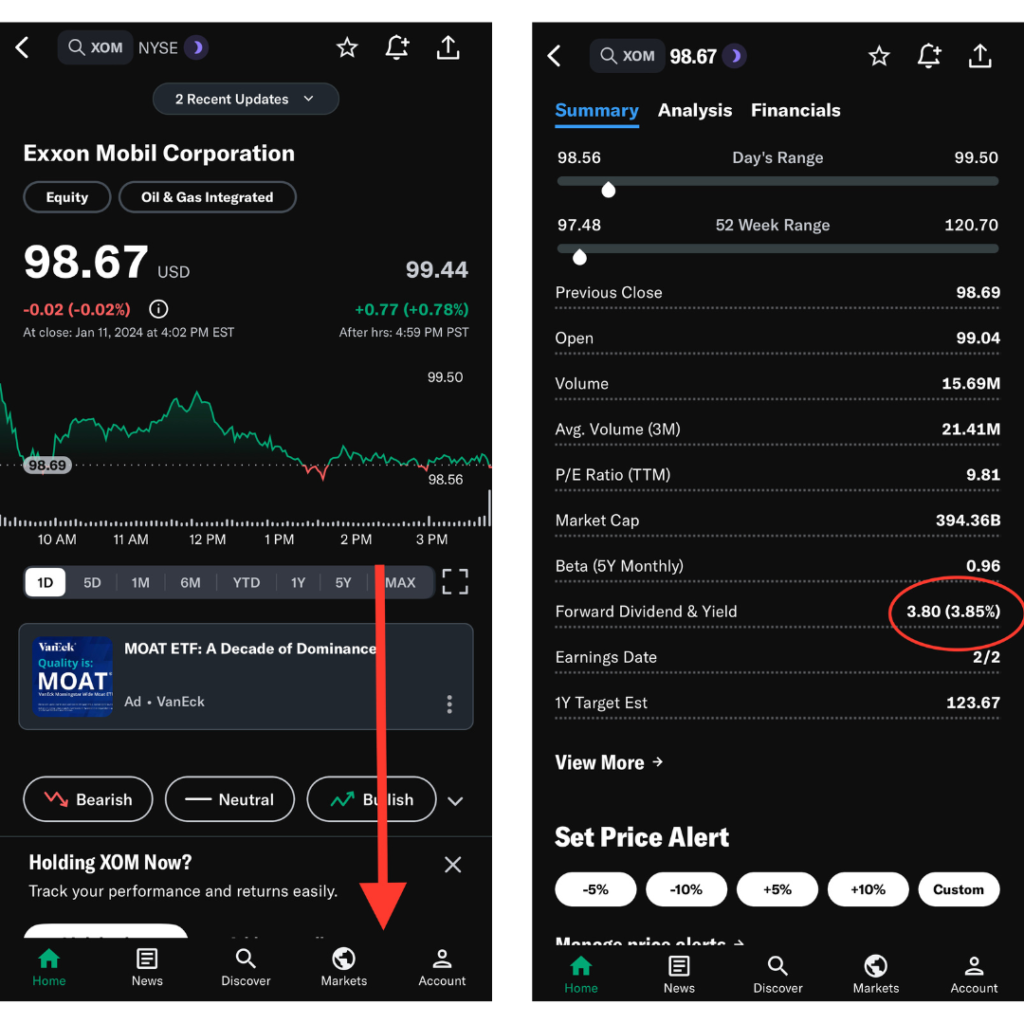

If you are using the Yahoo! Finance app to complete today’s activity, then follow these step:

- Enter the ticker symbol

- Scroll down and under the chart

- Locate the “Forward Dividend & Yield”

- Use “Forward Dividend Rate” and divide by 4 to get the most recent payment

- Use “Forward Annual Dividend Yield” for the Dividend Yield

STEP ONE:

Select the stocks from your watch list and locate the dividend information. If there is no dividend information, then the company does not issue dividends.

STEP TWO:

Write the Ex-Dividend Date (Click “View More –>” below the company’s description

3-Business Days Prior

Dividend Rate, and Dividend Yield

Calculate the Dividend Payment for 1,000 shares

STEP THREE:

Share a screenshot of your worksheet in The Stocks & Stilettos Society or let us know in the comments below.

Bonus Activity: Set appointments in your smart phone for the next quarterly (or monthly) dividend date for each dividend stock you own. Also, set an appointment for 3 days prior to the next ex-dividend date for each stock you wish to own by the end of Q2-2024 (or June 30, 2024).

Good exercise! I have an E-trade account. I can’t wait to get in there and start understanding what I am seeing.