It’s not too late to share with your friends. Send them your personalized link or have them join at bit.ly/2024slaywithstocks

If you missed some of the challenge and would like to review previous days, you can view the previous days –> here.

This training/challenge is for educational and informational purposes only. These materials do not constitute a recommendation to engage in any particular securities transactions.

Investment products are: Not FDIC Insured | Not Guaranteed by the bank | May lose value

Week 1: Let it Slay – Stock Basics

This week is all about setting the stage to be successful as a new investor. You’ll get an introduction to stocks and the stock market to help you build a foundation for investing for years to come. No need to fear – We’re starting at the bottom and will work our way to the top. This is a great place to start on your investing journey.

Compounding Interest

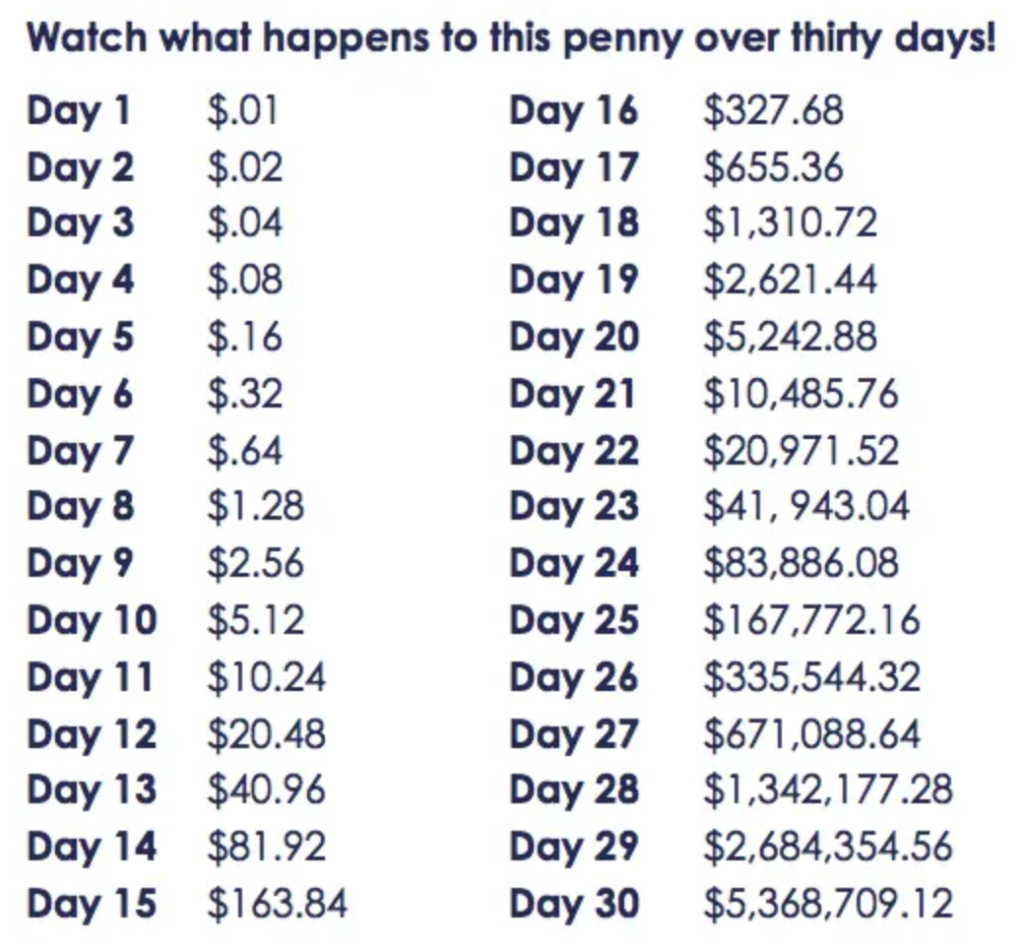

If you had a choice, would you choose to take $1 million, today or a penny that will double every day for the next 30 days? Most would take the $1 million and run. However, if you took the penny that doubled for 30 days, then you would walk away with a cool $5,368,709.12. Unbelievable, right? Well, that’s the power of compounding. The chart below, shows how that penny goes to work with compound interest.

Compound Interest is interest that is calculated on your initial investment AND any interest you have earned in previous periods. It’s as if each dollar was having multiple babies and then those babies start having multiple babies and so on.

Compounding will make your money grow at a faster rate than if it was earning simple interest (interest that is only calculated on your initial investment). Simply put, it is interest on interest or as I like to say, “money on top of money”. With stocks, your funds are able to work for you while you are asleep or busy with life using this nearly magical concept known as compound interest. The more money you have compounding, the more magic gets applied, and the faster your money grows.

Day 4 – Earning Interest: Compounding

Did you know that 59 percent of women guess how much they will need and don’t even consider the interest rate needed to reach a financial goal, such as retirement? Looking at the amount we need to save per month, pay period, or every year helps you to begin to put a plan in place. Your goal should be to find the highest possible interest rate, while minimizing risk, to help you reach your goals. What better way than to do that by investing in a company that has been around for a long time with a stock that has a proven track record? With an investor’s mindset, you need to find investments that will help you meet your financial goals.

With stocks, you can take advantage of rates of return that may allow you to reduce the amount you need to save per month and/or reduce the amount of time it takes to reach your goal. Doesn’t that sound great! This allows you to take the pressure off of only focusing on working for the money, but to shift your thinking (and actions) to finding stocks that will provide you with the rate of return you need for your money to work for you.

Today’s Investing Activity:

Watch the video —> HERE

Part I – Select a goal and a stock from your watch list to determine how much you need to save per month.

Today’s activity focuses on understanding how much you need to save and the power of stocks to help your money grow using compound interest. This helps you to identify stocks that may carry a little more risk than you may be accustomed to, but that allows your money to do the heavy lifting to meet your financial objectives. Although past performance is not an indication of how a stock will perform in the future, using past performance gives us a little insight into how well (or bad) a stock price has grown (or not grown). At the end of the day, it’s all about telling your money what to do and how hard to go to work for you using the power of compound interest

Select a goal and a stock from your watch list to determine how much you need to save per month. Select another goal and do the same thing, except determine the amount of time it will take to reach your goal.

Use the “Compound Interest Worksheets” –> (HERE) to complete today’s assignment. Feel free to take a screen shot of your worksheet and share with the group or leave a comment with your results.

STEP 1 – Locate Prior Year’s Stock Performance

Select one of your stocks from your watch list to use for prior year’s performance. If you are using the Yahoo! Finance app, then follow these steps:

- Enter the ticker symbol

- Under the chart, select “1Y”

- Roll your finger across the chart until it reads “Dec 29” (or the last week day of the year)

- Write the percentage down on your worksheet

STEP 2 – Select a goal and determine the savings rate or time to goal

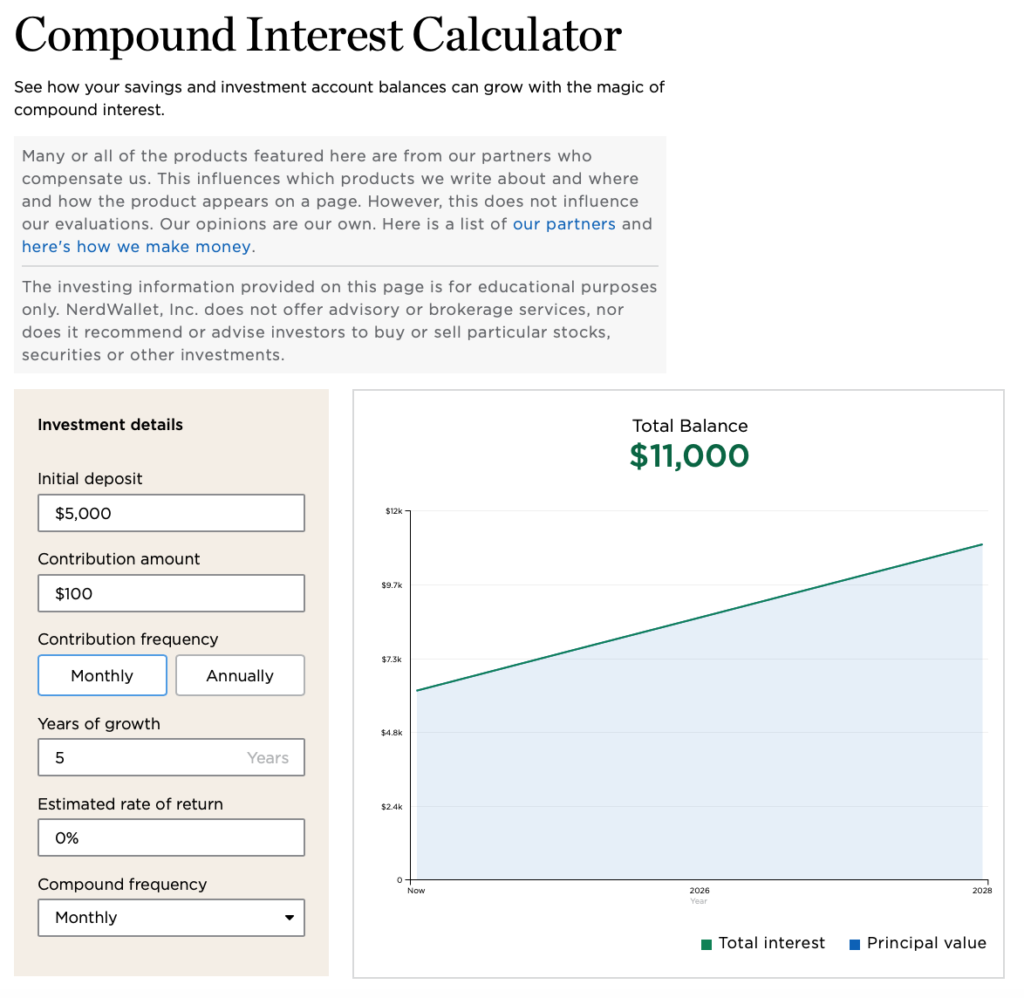

Select one of your goals and write the information on the worksheet or on paper. Use the Compound Interest Calculators at Nerd Wallet (Click Here ==> Nerd Wallet) to help you determine the following:

MONTHLY SAVINGS/INVESTMENT GOAL

or

RETIREMENT SAVINGS GOAL

- Select a stock from your watch list and find out the interest it earned last year

- Select one of your goals and use the Nerd Wallet calculators to determine your monthly savings rate (HERE)

- Repeat for retirement savings goal to determine the amount of you will need to save (HERE)

- Share a screenshot of your worksheet in The Stocks & Stilettos Society or let us know in the comments below

That’s it!

Tomorrow: Day 5 – Account Elevation: Dividends

Follow me here: Instagram: @StocksandStilettos | Facebook: @StocksandStilettos | X: @StocknStiletto

Group: bit.ly/stocksandstilettos

Happy Investing!

Cassandra

OMG! I may not remember to post my information but what I will say is that I have work to do. This compounding interest has been a huge eye-opener. I am now going to research all my stocks present and future to determine how to make this work to hit my goals. Thank you so much!

No worries. Compounding will definitely help you get there. You’re welcome and see you soon!

Question: after doing the work and figuring what the monthly contribution would be, I wonder could I take $300/month and divide it over multiple stocks each month?

Does the amount I contribute each month have to equal the stock price?

Hi Stocksistar, the amount you contribute does not have to equal the stock price. You can purchase fractional shares of k different companies. This allows you to purchase what you can afford to be able to invest in the stock market.

This exercise was difficult for me because I don’t understand the 5yr rate of return. However, it was a huge eye opener in reference to my current savings goals. I need to step my game up.