It’s not too late to share with your friends. Send them your personalized link or have them join at bit.ly/2024slaywithstocks

If you missed some of the challenge and would like to review previous days, you can view the previous days –-> here.

This training/challenge is for educational and informational purposes only. These materials do not constitute a recommendation to engage in any particular securities transactions.

Investment products are: Not FDIC Insured | Not Guaranteed by the bank | May lose value

Week 2: Make it Slay – Stock Trading

This week it’s time for some action as a new investor. You’ll learn by doing when it comes to purchasing stocks and navigating the stock market to help you build a foundation for investing for years to come. No need to fear – We got you!

Order

An investor’s bid to buy or sell a certain number of shares of stock. You have to submit an order to buy or sell stocks, bonds, mutual funds, etc. Placing an order to purchase stock is called “Opening the Trade”. There are several ways in which you can place your order to purchase stock.

Day 11 – Placing Stock Orders

Watch the video —> HERE

When placing an order to purchase stock, there are several different types of orders that give your online discount broker a set of specific instructions to buy stock on your behalf. For the purposes of this challenge, we will discuss the two primary types of orders.

Market Order – This is an order to buy a stock, immediately at the current market price. Market orders are typically executed right away by your discount broker and you have no control over the current price or when the order gets executed. They are often referred to as unrestricted orders. In a fast moving market, the price of a stock can change substantially between the time you place the order and the time the order is actually completed.

- Market orders guarantee execution.

- Best to use when a stock has high trading volume.

Limit Order – This is when you enter an order to buy a stock at or below a set price. A limit order protects you, because it limits the amount you are willing to pay. By placing a buy limit order, you provide instructions to the broker to buy the stock for you in an effort to avoid paying a price higher than you expected.

- Limit orders guarantee price.

- Can be used with any trading volume.

Although you can protect yourself on the price you are willing to pay, if the price you specified is never reached in the market, then your order won’t be triggered. When you set a limit order, it is only good until the end of the trading day and then it expires if your order has not been triggered.

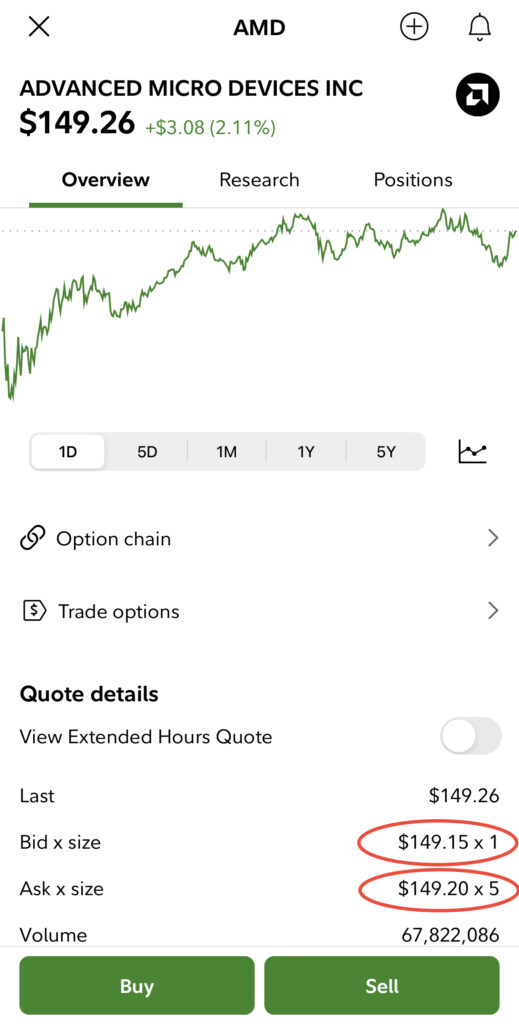

How to read the order screen

When you are ready to place your order, a small box will appear with pertinent information to help you in your decision to move forward with your order. But, what does it all mean? Here’s a few things you need to know.

Ask – The amount an investor is willing to pay for the stock

Bid – The amount an investor is willing to sell the stock for. This amount is always lower than the “Ask”

Spread – The difference between the “Ask” price and the “Bid” price. The lower the spread, the better chance you have to get the stock at the price you set for a limit order.

In the above example, the “Ask” price is $149.15 The “Bid” price is $149.20. Therefore, the “Spread” is $0.05 (149.20 – 149.15). If you were to submit a Limit Order, any price between $149.15 and $149.20 or lower would be appropriate.

Today’s Investing Activity: Today’s activity focuses on different types of orders you can submit to buy stock. By reviewing the Ask and Bid prices, you are better able to make a decision when about the price you are willing to pay, as an investor, instead of leaving it up to chance and letting the markets decide for you.

Using the Market Order Worksheet, locate the “Ask” and “Bid” prices. Calculate the “Spread”. Repeat for Target. Then, select one of your stocks from your worksheet and do the same. (Note: You may need to click on “Trade” and select “Buy” in order to get the Ask/Bid information for your stock.)

- Locate the “Ask”, “Bid”, and “Market” price. Calculate the “Spread”.

- Complete the information for Netflix.

- Select a stock from your watch list and complete the information.

- Share a screenshot of your worksheet or let us know your results in the comments below

You can download the “Market Order Worksheet“ to help you with today’s activity. Feel free to take a screen shot of your worksheet and share with the group or leave a comment below.

STEP ONE:

Locate the “Ask”, “Bid”, and “Market” price. Calculate the “Spread”.

Complete the information for Netflix

STEP TWO:

Select a stock from your watch list and complete the information

STEP THREE:

Share a screenshot of your worksheet or let us know your results in the comments below

Today’s activity focuses on different types of orders you can submit to buy stock. By reviewing the Ask and Bid prices, you are better able to make a decision when about the price you are willing to pay, as an investor, instead of leaving it up to chance and letting the markets decide for you.

Tomorrow: Day 12 – Trading: Open the Trade

Follow me here:

Instagram: @StocksandStilettos | Facebook: @StocksandStilettos | X: @StocknStiletto

Group: bit.ly/stocksandstilettos

Happy Investing!

Cassandra

NETFLIX INC- NFLX Target- TGT

Ask- 485.000 Ask- 137.88

Bid 482.51 Bid- 137.40

Spread 485.00-482.51 = 2.49 Spread 137.88-137.40=0.48

Market Price 482.09 Market Price=137.40

Provide a Limit Order price- 482.50 Provide a Limit Order price- 137.60

Netflix (NFLX)

Ask: 485.00

Bid: 482.51

Spread: 2.49

Market Price:482.09

Limit Order Price: 483.00

Target (TGT)

Ask: 137.60

Bid: 137.01

Spread: 0.59

Market Price:137.40

Limit Order Price: 137.50

Netflix (NFLX)

Ask: 485.00

Bid: 482.51

Spread: 2.49

Market Price:482.09

Limit Order Price: 483.00

Target (TGT)

Ask: 137.60

Bid: 137.01

Spread: 0.59

Market Price:137.40

Limit Order Price: 137.50